"What Is a Credit Score and Why Does It Matter?"

the reason credit matters, more than you think it does

4/20/20252 min read

What Is a Credit Score and Why It Matters More Than You Think!

Ever wonder what that mysterious 3-digit number really means?

Your credit score isn’t just a number—it’s your financial reputation, and it’s being checked more often than you think.

Whether you’re trying to rent an apartment, buy a car, get a new phone plan, or even land a job… your credit score could be the deciding factor.

What Is a Credit Score, Really?

A credit score is a numerical rating of how trustworthy you are with borrowed money. It tells lenders how risky—or safe—it is to let you borrow cash, get approved for loans, or open credit cards.

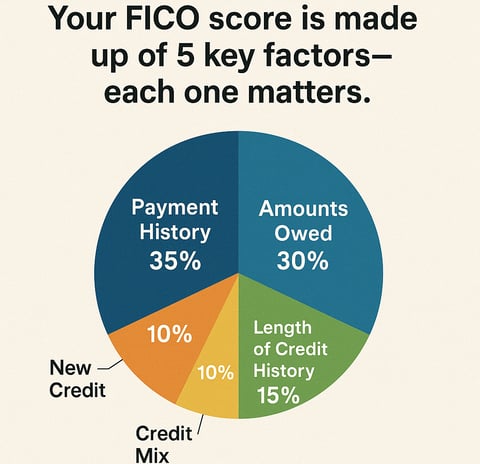

There are two major scoring models:

FICO Score – Used by 90% of lenders

VantageScore – Gaining popularity but used less often

Both use a similar scale:

Poor (300–579), Fair (580–669), Good (670–739), Very Good (740–799), Excellent (800–850)

Why It Matters More Than You Think

Here’s how your credit score affects everyday life:

✅ Lower Interest Rates – Good credit saves you thousands over time

✅ Faster Approvals – Whether it’s a car loan, home loan, or even utilities

✅ Bigger Buying Power – Credit cards with better perks & higher limits

✅ Better Living Options – Many landlords and employers check your credit

✅ Peace of Mind – You’re financially flexible and less stressed

📉 What Hurts Your Score?

Here are a few major credit killers:

Late payments

High credit card balances

Too many hard inquiries

Collections or charge-offs

No credit history at all

💡 Final Thoughts

Your credit score isn’t set in stone. With the right strategy and a little help, you can raise it faster than you think.

Ready to take control of your credit?

👉 [Book a Free Consultation with Novas Credit Today]

Let’s turn your credit around—one smart move at a time.